Don’t worry! In a short time, you could have your down payment saved and become a homeowner. Take a look what Mississippi REALTORS® did for future homeowners in Mississippi.

What Is It?

Mississippi REALTORS® was successful in helping get legislation passed in 2017 that created a savings account for first-time homebuyers that offers tax advantages for individuals up to $2,500 a year and up to $5,000 a year for couples.

Who is it for?

Any Mississippian who has never purchased, owned or part-owned a home in Mississippi or any other state.

Why would I want to create one?

When you are ready to buy a single-family home, you will have money saved to help make the purchase. Plus, money deposited in the account is deductible from state income, which lowers your tax bill. Interest earned on the deposits is also free from state income tax.

Where can I create an account?

You can create a First-time Homebuyer Savings Account at any bank, credit union, or other financial institution licensed to do business in Mississippi. It can be a cash deposit account or money market account.

When can I create one?

You can open a First-time Homebuyer Savings Account and start saving today. You can start taking a tax deduction beginning in the 2018 tax year.

How does it work?

Beginning in 2018, individuals can deduct up to $2,500 from their state adjusted gross income when they make deposits into a First-time Home Buyer Savings Account. Couples can deduct up to $5,000. It's a dollar-for-dollar deduction up to the limits (i.e., If an individual deposits $50, then it's a $50 deduction. If an individual deposits $3,000, it's a $2,500 deduction. If a couple deposits $50, it's a $50 deduction. If a couple deposits $6,000, it's a $5,000 deduction.)

Is there a limit on how much money I can save?

No. Every year, individual filers can save up $2,500. Married couples filing jointly can save up to $5,000 every year. Deposits can be made year after year so long as at least one (1) qualified account holder remains alive.

Can I put more than $2,500 into my First-time Homebuyer Savings Account one year?

A single account holder and married couples filing jointly can deposit more than stated limits each year, but the excess money is not eligible for a tax deduction and is treated as ordinary income.

What can savings be used for?

Savings can be used for down payments, loan origination charges, appraisal fees, credit report fees, flood certifications, title charges, deed charges, and other closing costs on the settlement statement of the first-time purchase of a single-family home by a qualified beneficiary.

What homes are eligible?

Eligible single-family homes include newly-constructed homes, existing homes, manufactured homes, modular homes, mobile homes, condominium units, or cooperatives.

Do I pay Mississippi taxes when I pull money out of my First-time Homebuyer Savings Account?

No, as long as the money is used for a down payment or allowable closing costs of a first-time home purchase in the state of Mississippi by a qualified beneficiary.

Can I open an account for a child or grandchild?

Yes; the law defines an “account holder” as an individual who establishes a savings account individually or jointly with one or more other individuals. A grandparent can open an account with a grandchild. The grandchild, as a qualified beneficiary, could claim first-time homebuyer savings account status on his or her Mississippi income tax return when he or she qualifies to file one. Remember that only cash and marketable securities may be contributed to the account.

How do I take the deduction with the Mississippi Department of Revenue?

The Department of Revenue is creating forms to report First-time Homebuyer Savings Account contributions beginning with the 2018 tax return.

Do I pay federal taxes on the money?

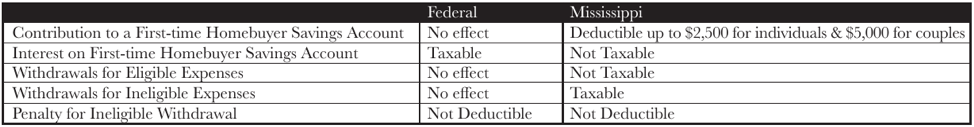

Deposits to the First-time Homebuyer Savings Account are exempt from state taxes up to the annual limit. However, the deposits are still subject to federal taxes, depending on your individual tax situation. Annual earned interest on the accounts is also exempt from state tax but is still subject to federal tax. (See Figure 1.)

Figure 1

Disclaimer: This FAQ provides general information and should only be used for general information purposes. This FAQ is not intended to be, and should not be considered, legal or financial advice. Any questions should be directed to a properly qualified legal, tax or financial advisor. For other FAQs visit FirstHomeMS.org.